As health systems are set to start reporting their third quarter earnings results this week, new research highlights hospitals’ ongoing fears about financial viability, patient volumes and supply stocks.

That’s as new hotspots in the Midwest report rising COVID-19 case loads and hospitals prepare for the pandemic to collide with flu season, potentially causing stress on capacity once again.

The takeaway is that most hospitals aren’t expecting a return to normal anytime soon, although it depends on the trajectory on ongoing efforts to develop vaccines and treatments. Most executives see 2022 as the timeline for seeing some regularity, according to Kaufman Hall.

About 20% of hospital executives surveyed by the group recently said they were “extremely concerned” about their financial viability until an effective vaccine or treatment is available. Another 50% said they were “moderately concerned.”

Some major hospital systems, however, have not fit this pattern. Earlier this month, HCA Healthcare previewed better-than-expected third quarter financial results and said it was returning all $ 6 billion it received from CMS in federal COVID-19 relief funding.

How health systems are doing now depends larger on their status at the beginning of this year, as well as market position and size, Lance Robinson, managing director at Kaufman Hall and one of the report’s authors, said.

“If you were strong going into the COVID crisis, you’re probably able to weather it much better than if you were teetering on low margins and low volumes to begin with,” he said. “So I think it really just exposed those health systems and providers that were already not doing well.”

Meanwhile, patient volumes are falling again after a rebound in early fall. And older people at a higher risk for severe symptoms from COVID-19 are less likely to return for care, according to a Kaiser Family Foundation analysis of Epic EHR data.

That research showed that total admissions for this year will come in about 10% lower than had been forecast, possibly more if restrictions on elective procedures are reinstituted later this year.

“[I]f the coronavirus begins to spread more rapidly later in the fall and non-emergency procedures are once again delayed, it could have serious consequences both for hospitals’ financial stability and the health of patients,” according to the report.

Outpatient volumes are also rebounding at a varying rate, according to a Commonwealth Fund report published last week. While some areas like dermatology and opthalmology are seeing rates actually exceed pre-pandemic levels, most are still falling short. Pulmonology, for example, is 20% below pre-pandemic levels still.

Multiple reports have shown crashes in pediatric visits, putting a strain on children’s hospitals across the country.

Hospital executives are also dealing with changes in workforce and expenses. Three-quarters told Kaufman Hall they are ramping up monitoring and resources going toward mental health and burnout concerns among staff.

They noted that costs for personal protective equipment and labor expenses for nursing staff have increased significantly.

The Kaufman Hall survey conducted in August found 40% saying case numbers are rising and 36% saying they’re staying level. Nearly half said the length of stay among COVID-19 patients had led to them canceling elective procedures.

That isn’t likely to have improved in the past two months. Eight states set new records last week for novel coronavirus infections recorded in a single day, according to the COVID Tracking Project, and fears about another surge in the coming weeks abound.

Volumes are also varying by service area. About 60% of respondents said oncology levels had returned to 90% of what they were before the pandemic. Not quite half said the same about cardiology surveys while orthopaedics, neurology and radiology trailed at 37% reporting nearly normal volumes. Pediatrics was in the last at 22%

Executives said they are worried about the expected changes in payer mix. The biggest concern is an increase is uncompensated care, followed by higher percentage of self-pay and Medicaid patients.

Those concerns are far from unfounded. At the beginning of this month, more than 4 million people had enrolled in Medicaid because of the pandemic and resulting recession. And more than 14 million may have lost health coverage because of job losses.

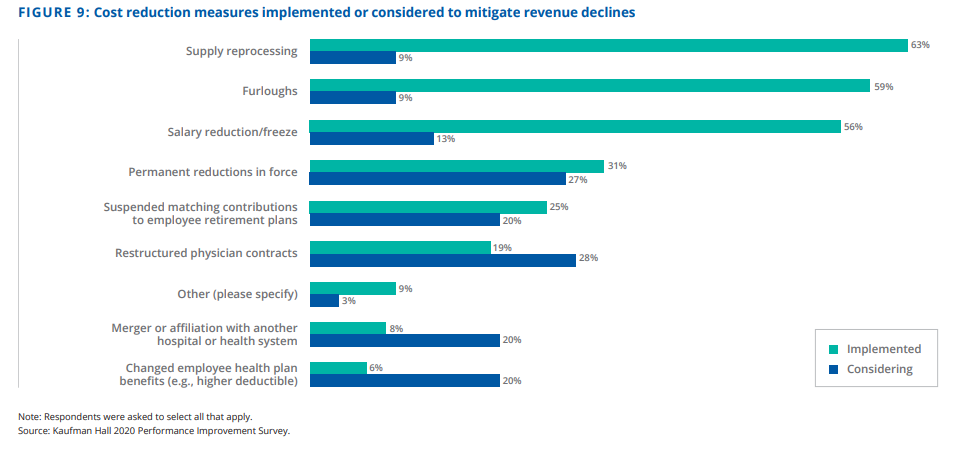

To help offset those adjustments, executives are turning to supply reprocessing most, according to Kaufman Hall. After that, nearly 60% said they implemented furloughs and 56% instituted salary freezes or reductions. That was followed by permanent workforce reduction (31%), suspending matching contributions to retirement plans (25%) and restructuring physician contracts (19%).

Permission granted by Kaufman Hall

Supply chain concerns have not entirely waned. In recent months, hospitals have been focused on building up stockpiles of personal protective equipment to prepare for potential case surges. Some states, like California and New York, have mandated they have a 90-day supply on hand.

That presents a new challenge of logistics and warehouse management, said Jeff Ashkenase, group vice president at group purchasing organization Premier.

Providers are generally feeling much better about their access to PPE than they did in March and April, but they may never feel secure that they have enough of everything that could be needed, he said.

“So, we’re sort of operating in peril,” he said. “We’re operating in normal cases and volumes and the types of work that we did and simultaneously building up the stockpile.”

Only 3% of hospital staff responding to a recent survey from Premier said accessing the Strategic National Stockpile through their state was an “easy process.” About 30% said it was difficult, while 44% said they “managed” and 22% did not access the national stockpile.

Ashkenase called for more coordination to improve the efficiency of shared stockpiles. “With all the stockpiles, the need for more transparency on what’s in the stockpile and how to access it, when you will get it, will be beneficial,” he said.

Respondents to Premier said regulatory flexibility had been most helpful to them in preparing for another wave. Expanded telehealth coverage and payment was cited the most, followed by reimbursement for alternative care settings and workforce changes like allowing clinicians to practice at the top of their license.

As major public hospital operators begin their Q3 earnings reports with Tenet leading the pack Tuesday, Robinson said he’ll be watching for what areas are seeing patients returning and how quickly.

“And then on the expense side, it’s obviously the PPE and the staffing requirements that are going to need to be out there, especially if we have a third wave of COVID,” he said.

And looking even farther out, the traditional method of looking to the past year’s metrics won’t work when looking toward 2021 and 2022, Robinson said.

“I think clients are struggling with, ‘How do I even begin to build a budget for 2021? What does that look like?'” he said.