Christian Gormsen is the CEO hearing aid startup Eargo. Courtesy of Eargo

When Eargo CEO Christian Gormsen was approached by the venture capital arm of Danish pharmaceutical giant Novo Nordisk in 2013 to join a fledgling startup making hearing aids, he says he told them, “I’ve seen all the startup attempts in the hearing aid space, and frankly none of them have been worth the paper that the business plan was written on.” Gormsen had been an executive at hearing aid maker GN Store Nord in Denmark for about five years, and he knew how challenging it would be to break into an industry where 98% of the market was dominated by six manufacturers.

Then he was shown the prototype made by Eargo’s cofounders, Daniel Shen, Florent Michel and Raphael Michel. He was impressed with what they had built. By 2014, Gormsen says, he’d joined as a board member, and by 2016 he’d decided to come on as CEO. Gormsen says Eargo has sold hearing aids to over 20,000 people since launching commercially in 2017. It’s one of a couple of hearing aid startups that follows a model similar to that of online eyeglasses seller Warby Parker, which lowers the cost of eyeglasses frames and lenses by cutting out middlemen.

The Food & Drug Administration estimates that some 37.5 million people over 18 in the U.S. need a hearing aid, and the World Health Organization estimates that some 466 million need them around the world and 900 million will require them by 2050.

For the past several decades, the market has been dominated by six big manufacturers: Starkey Hearing Technologies, GN Store Nord, Sonova, Sivantos, William Demant and Widex. (Widex was recently acquired by Sivantos.) They often sell their hearing aids to middlemen, that is, audiologists, who test patients’ hearing and fit them with hearing aids patients in a brick-and-mortar store. (Some companies also sell to big box stores like Costco.) The average cost of a hearing aid is $ 2,300, according to a 2015 report from the President’s Council of Advisors on Science and Technology.

Related: This $ 1.5 Billion Health Startup’s ‘Smart Pills’ Keep Patients From Forgetting

Better Diabetes Care: Health Startups Get Paid When Patients Get Better

That model has worked well. For example, Sonova, a publicly traded company with a market capitalization of about $ 13 billion, made $ 410 million on sales of $ 2.7 billion in its most recent fiscal year. Sonova and Starkey Hearing Technologies have each minted billionaires in the past five years. (Sonova’s largest individual shareholder, Beda Diethelm, has a net worth of $ 1.5 billion, and Starkey Hearing Technologies’ owner and CEO, Bill Austin, has a net worth of $ 2.6 billion.)

But now startups like Eargo are aiming to largely cut out that in-person process, and they’re banking on having more tech-savvy baby boomer customers in the future. Here’s a look at two trying to take on the big players.

Eargo

Cost to consumer: Starts at $ 1,650 for a set of two hearing aids

Raised: $ 180 million (according to Pitchbook)

Headquarters: San Jose, California

Year founded: 2010

With backing from investors such as New Enterprise Associates, Maveron, Nan Fung Life Sciences and the Charles & Helen Schwab Foundation among others, Eargo sells hearing aids online or over the phone. At the minimum, customers simply check a box in a form acknowledging that they are okay with forgoing a medical evaluation by an audiologist. Still, Gormsen says that the company has some 30 in-house audiologists who act as “care providers” to answer customers’ questions when they’re ordering and after they’ve received their hearing aids. Similar to Warby Parker, Eargo also has 14 storefronts in the U.S. where customers can come in and try out Eargo’s products. “I was highly skeptical, as a dinosaur, that people would be willing to make health decisions online or over the phone, but the Baby Boomer demographic really surprised me in how willing they are to research and how technically adept they are,” Gormsen says.

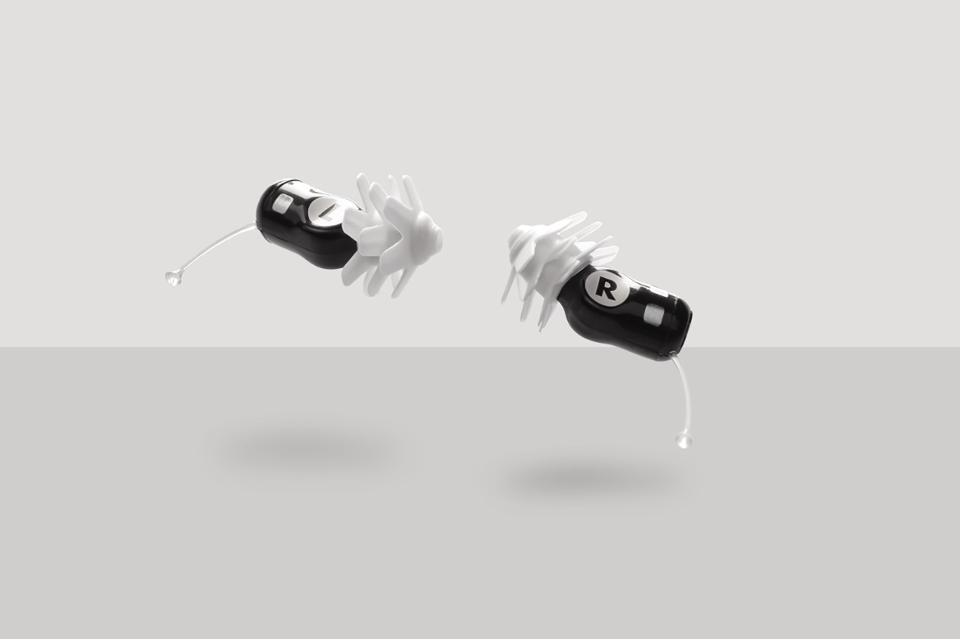

A set of hearing aids sold by Eargo. Courtesy of Eargo

Audicus

Cost to consumer: Starts at $ 700 per hearing aid

Raised: $ 4.2 million (according to Pitchbook)

Headquarters: New York City

Year founded: 2012

Audicus doesn’t make hearing aids but focuses solely on distribution. Founder Patrick Freuler says he learned the ins and outs of the hearing aid industry working as a consultant for Bain & Company, where he worked researched potential investments in some of the big hearing aid manufacturers. “Think about how optometry offices looked 40 or 50 years ago,” Freuler says. “That’s essentially the experience you get. It involves a lot of back-and-forth, a lot of advising, a lot of repeat visits. It really is a bit convoluted.” The company has partnered with an independent manufacturer (Freuler would not disclose which one) to sell its own brand, called the Clara. Before customers can purchase their hearing aid, they submit a hearing test that’s reviewed by Audicus.

OTC hearing aids

Still, what many are waiting for is the implementation of the Over-The-Counter Hearing Aid Act, signed into law by President Trump in 2017. It gives the FDA until 2020 to create regulations that will let customers buy hearing aids over the counter, without the involvement of any of kind of hearing professional, introduced as another way to lower prices for consumers, because hearing aids are rarely covered by health insurance. Companies are already preparing for the change, which is expected to shift more of the decision-making to consumers. CVS Health, for instance, announced in March that it would close about 30 of its hearing centers. While Eargo has no plans to go after the over-the-counter market, Freuler says Audicus would be open to partnering with other companies that have products they want to sell over the counter.

To stay in the loop with Forbes Health coverage, subscribe to the Innovation Rx newsletter here.